child tax credit october 2021 schedule

Ad The new advance Child Tax Credit is based on your previously filed tax return. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

Child Tax Credit Dates Next Payment Coming On October 15 Marca

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the.

. The IRS began sending out the fourth of six monthly child tax credit payments on Friday 15 October. Recipients can claim up to 1800 per. What is the schedule for 2021.

For 2021 the American Rescue Plan raised the maximum child tax credit from 2000 per qualifying child to 3600 per qualifying child age 5 and under and to 3000 for children age 6 through 17. Pursuant to the American Rescue Act of 2021 pertaining to the tax year 2021 only the child tax credit can be as much as 300000 per child for children ages 6 through 17 and 360000 for children ages 5 and under. Still time for eligible families to sign up for advance payments.

Income limits for the 2021 child tax credit are lower than they were for the original child tax credit. That means parents. Thats an increase from the regular child tax credit of up to.

Normally Tax Day would be on April 15 however during years like these when Good Friday lands on April 15 Tax Day is extended to the following Monday. The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. Is There An Increase In Child Tax Credit For October 2021.

As part of the continuing process of building out the advance CTC program which has included outreach to bring in previous non-filers and the launch of the CTC Update Portal that has allowed millions of. Up to 300 dollars or 250 dollars depending on age of child. Six payments of the Child Tax Credit were and are due this year.

The Child Tax Credit has seen serious changes that may complicate your tax returns for 2021 with substantive changes to the credit updated forms and instructions in 2021. The next monthly 2021 Child Tax Credit payment is slated to hit bank accounts on Friday Oct. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

16 October 2021 0558 EDT. WRBL The 2021 tax deadline is quickly approaching. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

Until the end of 2021 Child Tax Credit stimulus checks will be mailed on the 15th of each month. Pursuant to the Tax Cuts and Jobs Act of 2017 the refundable portion of the child tax credit was limited to 140000 per child. Child Tax Credit Payment Schedule for 2021.

Lynn IschayPlain Dealer The Plain Dealer. Most taxpayers received advance payments in 2021 and the credit is fully. October 29 2021.

With families set to receive 300 for each child. Tax deadline approaches. Up to 300 dollars or 250 dollars depending on.

This years Tax Day falls on April 18 2022. The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families it believed to. If you still have questions or concerns regarding your Child Tax Credit check you should consult the IRS website since the agency has limited resources owing to a backlog of tax returns and delayed stimulus payments.

Parents of a child who. The complete 2021 child tax credit payments schedule. Families now receiving October Child Tax Credit payments.

Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. IR-2021-201 October 15 2021. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. The maximum amount went from 2000 to 3000 for those under 18 and up to 3600 for those under six. How to prepare what to know about child tax credits.

The advance is 50 of your child tax credit with the rest claimed on next years return. According to the 2019 child tax credit schedule the credit amount per child ages 16 to 17 will increase from 2000 to 3600 per child and from 3000 to 7000 for children 5 to 6.

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Schedule 8812 H R Block

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Will There Be Another Check In April 2022 Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

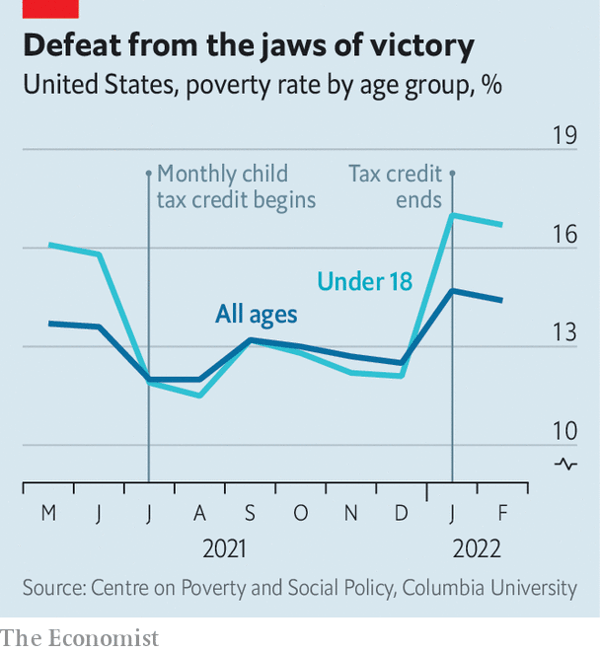

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

2021 Child Tax Credit Calculator How Much Could You Receive Abc News